Via Metal Miner

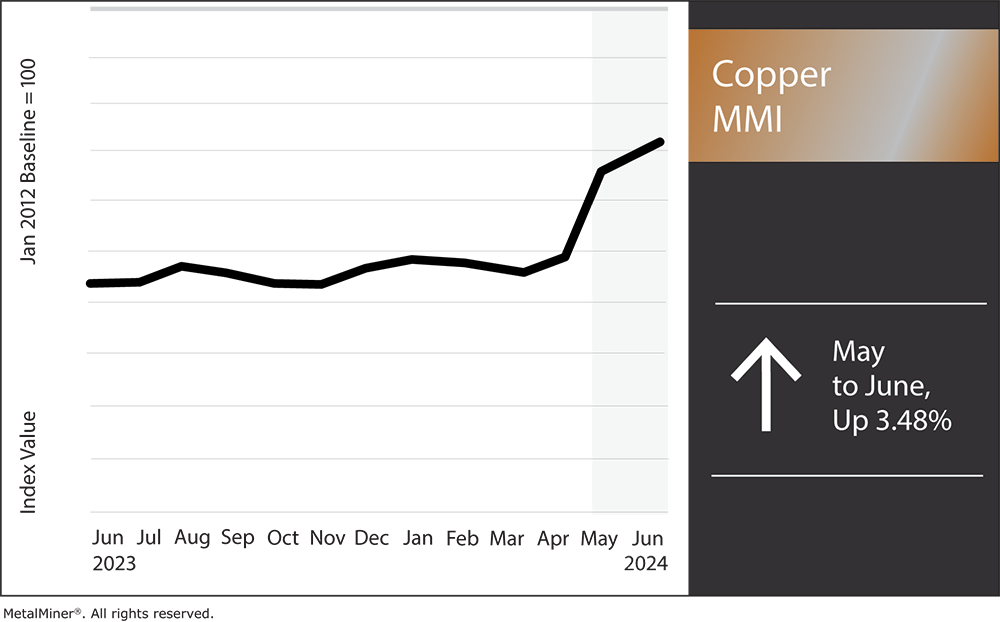

Overall, the Copper Monthly Metals Index (MMI) rose 3.48% from May to June.

A short squeeze helped the price of copper peak at a new all-time high in late May, followed by a sharp downside correction. This resulted in an overall 3.7% rise from the close of April. CME copper prices then continued to retrace during the first half of June, wiping out all of May’s gains as they continued searching for a new bottom. Copper markets are constantly shifting. Get all of the latest updates on what you should anticipate in future copper prices with MetalMiner’s weekly newsletter.

Speculative Copper Rally Unravels

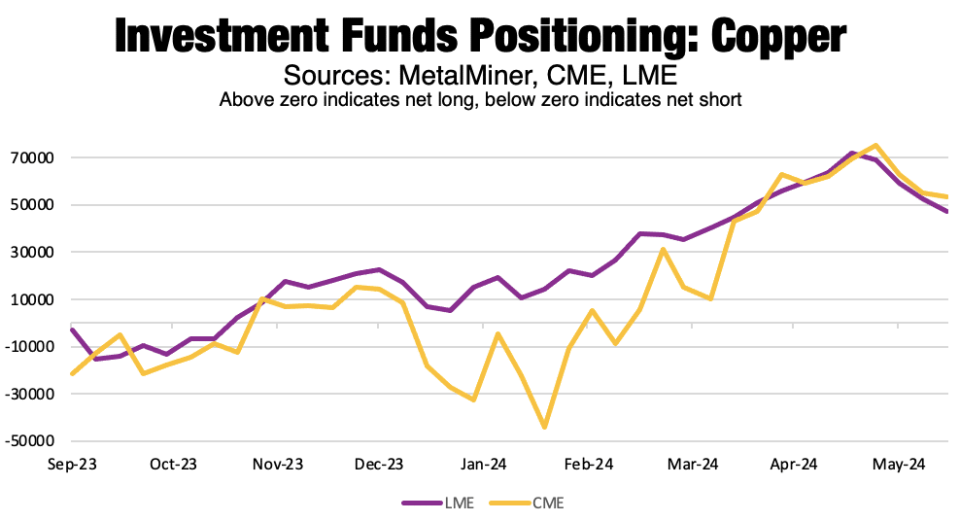

Last month, MetalMiner warned that the copper price uptrend appeared unsustainable and doomed for a correction. While the speculative frenzy offered enough momentum for CME copper prices to rise over 38% from their mid-February low to their late-May high, investors soon had to grapple with the reality of the current market: demand was not ready… yet.

By June 18, copper prices had fallen 12.46% from their peak almost one month ago as investors began to pull back from a rally that climbed too far too fast. Both CME and LME Commitment of Traders data showed investment funds began to pull back long positions by late May, a trend which remained ongoing as of mid-June.

Tepid Demand Impacting the Price of Copper

While copper prices embarked on a mostly straight climb up throughout most of Q2, their journey boasted unwavering red flags in the form of demand signals. The Lunar New Year in China saw a strong seasonal rebuild of SHFE inventories, which left them at their highest level since 2020. Meanwhile, the Yanshan Copper premium, a proxy for Chinese demand conditions, plummeted as copper prices surged. By mid-May, the premium fell into negative territory as Chinese buyers balked at eye-wateringly high copper prices. Little had changed as of mid-June, as the premium had yet to emerge from the below-zero threshold.

Meanwhile, LME copper prices offered no indication of strong demand conditions either. For instance, primary three-month copper prices held a historically high premium over primary cash prices. The wide contango suggested a well-supplied market, not one with demand conditions driving prices higher. On average, futures carry a nearly $14 per metric ton premium over spot prices, far beneath the current $138 per metric ton premium.

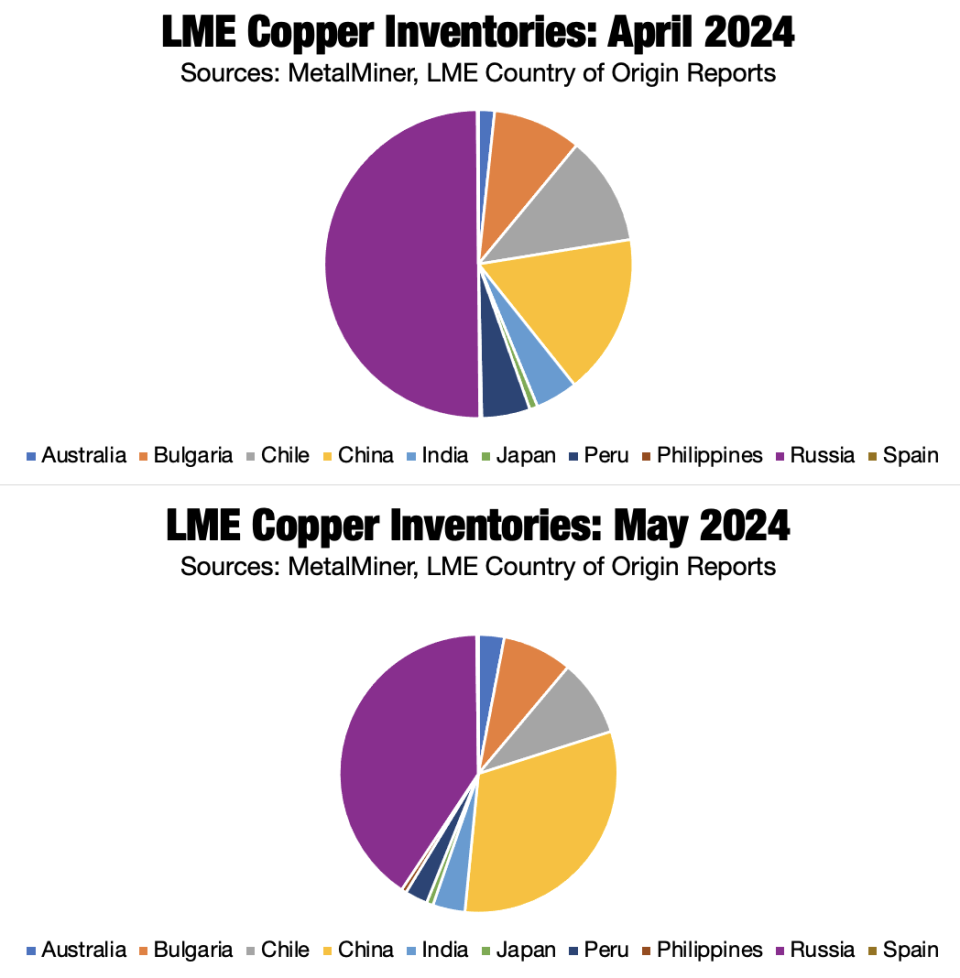

CME prices appeared narrowly backwardated, suggesting stronger demand conditions. However, U.S. demand alone would prove unable to outweigh the larger global market. The widening arbitrage of LME and CME prices over SHFE prices eventually began to shift trade flows toward Western exchanges. LME Country of Origin data showed that the supply of copper in China nearly doubled from April to May. By mid-June, LME inventories hit their highest level since February 2024 amid an ongoing rebuild.

Markets Seek New Bottom for Copper Prices

By mid-June, the ongoing downside correction for copper prices ate away all of May’s gains and some of April’s as markets searched for a new bottom. The most bullish voices in the market suggest the current retracement will prove short-lived before the bull market returns. Others warn that prices could return to their Q1 range in the coming months.

While long-term fundamentals offer considerable allure to the copper market, bearish demand signals remained as Q2 neared its close. The negative Yangshan premium in China, rising LME inventories and historically wide LME contango suggest little has changed within market conditions since prices found their peak. Although electrification and renewable efforts appear poised to hurtle the market into a deficit in the coming years, that deficit has not arrived yet. For now, economic headwinds continue to plague demand conditions.

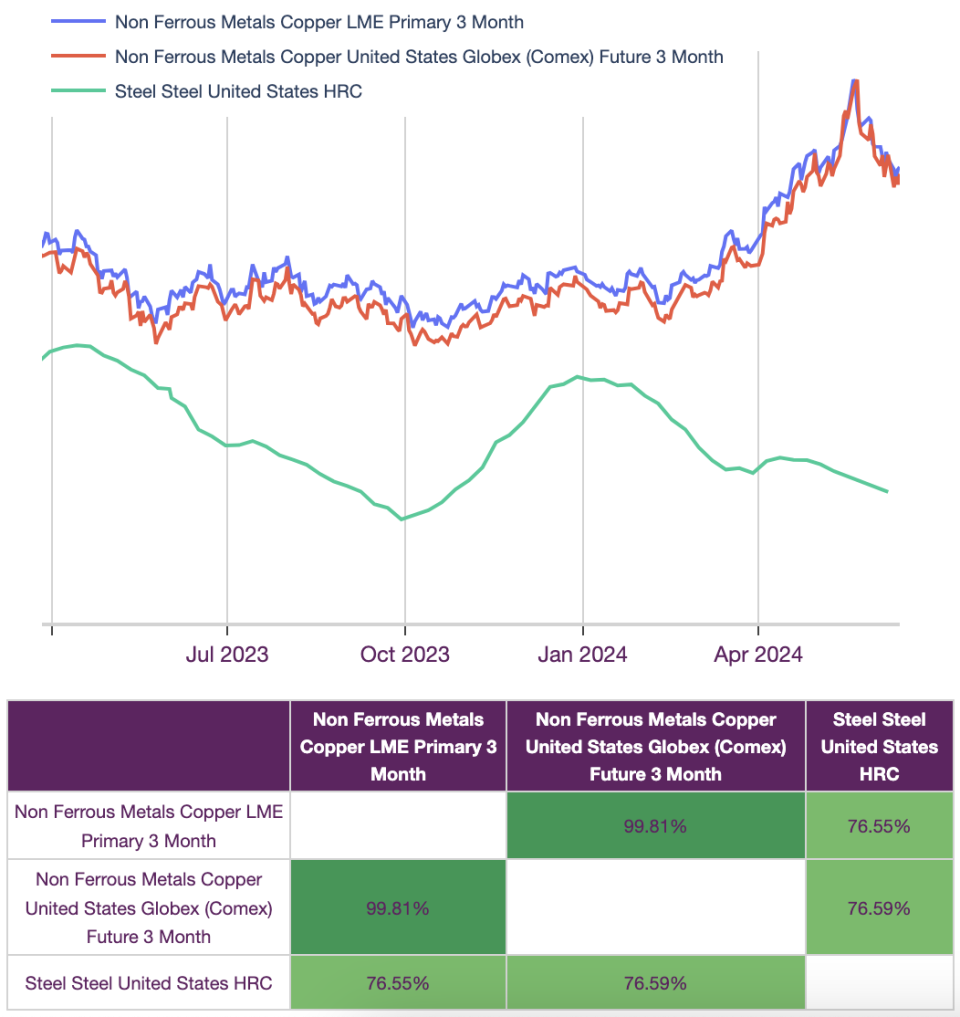

Meanwhile, U.S. steel prices skipped the uptrend witnessed across base metals throughout Q2. HRC prices have remained within an ongoing downtrend since the start of 2024, and now sit at their lowest level since October 2023. Meanwhile, domestic steel markets have started to report worsening demand as sticky inflation and delayed rate cuts by the Federal Reserve continued to pressure consumers and manufacturers. May marked the second consecutive month of contraction for the ISM Manufacturing PMI following a short-lived return growth in March.

Source: MetalMiner Insights, Chart & Correlation Analysis Tool

Domestic steel prices may prove a leading indicator for copper prices in the coming months. U.S. HRC prices boast a nearly 77% correlation to LME and CME copper prices, which suggests that the markets often echo one another. Bearish steel prices combined with reports of an increasingly challenged domestic market indicate a slowdown in the U.S., particularly as the impact of quantitative tightening efforts from the Federal Reserve over recent years compound. The U.S. proved more resilient than other markets over the past few years, which offered support to metal prices despite recessions in places like Europe. Should U.S. demand continue to erode, it could spell trouble for copper prices in the short term.

MetalMiner’s MMI report includes monthly copper price reports and is suitable for use as an economic indicator for contracting, price forecasting and predictive copper analytics. Sign up here.

Long-Term Copper Supply Deficit Remains on the Horizon

While copper prices remain in an ongoing correction, the long-term outlook appears unequivocally bullish. For years, warnings plagued the market that near-term copper supply could not support the ongoing global energy transition under its current parameters. Net-zero targets, which countries seemingly intend to reach through EVs, solar panels, and wind towers, would require a substantial amount of copper that cannot become available under the defined timeline.

Combined with eroding ore quality and the long development prices for new mines, electrification efforts will inevitably force the market into a deficit, resulting in higher prices and canceled projects. After all, nothing kills high prices like high prices.

A recent study from the University of Michigan and Cornell University similarly demonstrated the unrealistic path ahead. Adam Simon, U of M professor of earth and environmental studies, noted, “We show in the paper that the amount of copper needed is impossible for mining companies to produce.” Adding the emerging demand for data centers, which also require considerable amounts of copper for construction and power requirements, the copper market will force a global reconsideration of the current renewable strategy.

EV Transition Fueling Copper Demand

The transition toward EVs appears to be a large part of the problem. According to Simon, “Just to meet business-as-usual trends, 115% more copper must be mined in the next 30 years than has been mined historically until now. To electrify the global vehicle fleet requires bringing into production 55% more new mines than would otherwise be needed.” Therefore, it may prove a relief that the U.S. EV market remains challenged even amid considerable subsidies. The study also suggested that promoting hybrid electric vehicles would help mitigate supply constraints. While hybrids require more copper than ICE vehicles, it is less than the amount required by EVs.

As copper prices retreat, the long-term bull narrative remains intact. This will inevitably help prices find a bottom, although that may take months. The momentum and market sentiment behind the roughly 3-month uptrend proved incredibly strong. This, at the very least, suggests that when demand finally catches up, investors will likely be quick to pile on long bets once again. This will help fuel a strong rally in copper prices and base metals alike.

By Nichole Bastin

More Top Reads From Oilprice.com: